ELLIOTT WAVE BEAR MARKET

A quick note from Bangkok before my HK shuttle.

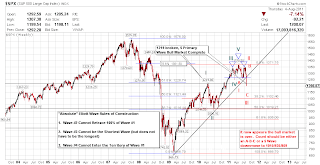

The markets melted down over night and now it appears a new Bear Market is confirmed according to Elliott Wave.

|

| SPX Elliott Wave |

The close last night broke below the Primary Wave 1 @1219. This has allowed for an objective Elliott Wave confirmation the 5 Wave Bull market from Mar, 2009 is over.

The 1st move on this decline should be to the 1150 area (head and shoulders top + measured move of the trading range for the past 6 months).

|

| SPX 50 dma Std Deviation |

As Aug and Sept are the 2 weakest months for the markets there is very little to stop us from continuing down. While I would normally wait to reduce my positions until the monthly chart confirms the move, I think it is wise to reduce exposure on any market advance in anticipation the monthly chart at the end of Aug will confirm the Elliott Wave analysis.

I will move to a 25% equity/75% cash position on any significant market advance over the next week. Good levels to sell would be 1222 and 1240 on the SPX.

Legal Disclaimer: The content on this site is provided without any warranty, express or implied. All opinions expressed on this site are those of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, OPTIONS, BONDS OR FUTURES. The author will reveal his current market positions and holdings but actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility. The author is not licensed as an investment advisor in the UAE and therefore cannot provide individual account advice to individuals and/or institutions.

For further information please use the following email address and I will do my best to get back to you when able.

ecamquestions@gmail.com

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home