On the verge of a sell signal

Fidelity Emirates Managed Equities Fund: $17.69 (11 May)

MLIM Emirates Managed Equities Fund: $16.33 (11 May)

For the week the mixed portfolio was up with the Fidelity fund up 2.43% and the MLIM fund up 1.49%. HOWEVER the big news of the week was the Fed increasing rates to 5% (another 1/4 point hike) which spooked the US markets on Thursday and Friday.

It is very important to note that 10 year US treasury rates are increasing and approaching a very important downtrend line:

The rates have already moved above the 50 month moving average. The last time this happened was the summer of 1999 which led to the bear market starting in Jan 2000. The downtrend line from 1990 intersects with strong resistance at approx 5.45%. Any push above these levels will be a huge negative for the market.

Will we get there.....I have my doubts. From what I can see the current rates are already having a slowdown effect on the US economy. The housing bubble will now start to deflate and along with it many US construction jobs (and the real possibility of a recession in the U.S.). I think the Fed might go one more rise and then pause to let the increases already in the system work their way through and see how the housing bubble, US dollar and the economy respond. A lot depends on inflation and whether it is contained with the current interest rate levels.

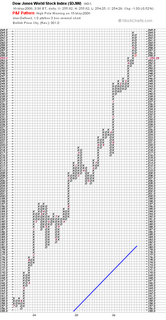

As for the stockmarket, here is the daily PNF chart I use extensively:

As you can see, a new row of "O's" has formed (these form with a 3-box reversal or $3.00 price change on the chart). 3-box reversals are a normal process as the market bobs and weaves it's way both higher and lower. From a technical perspective it would take a closing price of $250 or below to trigger a sell indication as it currently stands. Alternately if the price were to reverse $3.00 it would trigger a new row of "X's" which would still leave us in a bullish condition. As such, it is too soon on a purely technical level to issue a sell signal yet.

These next 2-3 days will be critical for the markets. I will post daily over the next 3 days to keep you updated. Hold your positions for now but get ready for a possible switch out of equities and into cash (DO NOT TAKE ANY POSITIONS IN BOND FUNDS).

As I said previous, if/when I make a move I will post here and tell you where I have put my money. The charts up until the past 2 days have been leaning heavily towards the Euro and Aussie dollar but the US dollar is at a critical point where a sudden (and unexpecteD) move to the upside might occur. I will post the charts and my analysis when the event occurs.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home