Bounced as promised

Fidelity Emirates Managed Eq. Portfolio: 16.61 (18 May close)

MLIM Emirates Managed Eq. Portfolio: 15.46 (18 May close)

For the week, the Fidelity equities fell 2.65% and the MLIM equities fell 1.68%.

As per my sell signal, I went to 50% cash in the Fidelity equities @ 16.86 and 50% to cash in the MLIM equities @ 15.81.

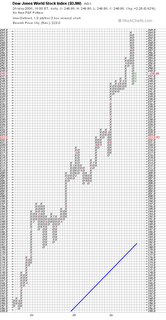

Also as per my previous post, the market is trying to set in place a floor around the 241-244 area on the DJW index PNF chart as below (click to enlarge):

It bounced off of an oversold condition last week as I indicated it would.

The daily line chart shows a solid line of support that the index bounced off of this week:

As per my post last week, until a break of the 241 level on the DJW index I will maintain my 50% position in equities and 25% in the Euro, 25% in the Aussie dollar.

I must stress the markets are at a HUGE decision point and that is the reason we have seen such a dramatic drop in the indexes over the past 2 weeks.

Central to the market confusion is whether inflation is of a concern in the U.S. or not. If it is, the bond market will be crushed along with stocks as the Fed will be forced to raise rates to combat inflation. Currencies (ie, the USD) will do well if the Fed has no other choice but to continue to raise interest rates. Interestingly along with that gold might also reverse it's recent slide and move concurrent with the dollar (which is counter-intuitive to the way it normally trades).

Alternately, if the Fed begins to see a slowdown in economic activity it will signal a pause in interest rate hikes. This will be good for bonds and stocks (and very bad for the USD).

Of great interest to me this week is an early indication of a positive reversal in the USD as per the following chart:

It generated a buy signal early in the week but it is premature at this point to call for a buy on the USD. But none the less it is worth watching.

As the data currently coming out is indicating a little of both (some for inflation, some for a slowdown), the next 3-4 weeks will be critical to the future of stocks. I will be watching the charts closely and signal my moves accordingly.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home