Weekly Update 03 June 2006

Fidelity Emirates Man. Eq. Port: $16.33 (01 June)

MLIM Emirates Man. Eq. Port: $15.25 (01 June)

For the week the Fidelity funds were up 0.99% and the MLIM funds up 0.33%. This was the bounce I expected and, while the signs are encouraging, I see no reason to revert back to a full 100% equity position at this time based upon this small "dead cat" bounce.

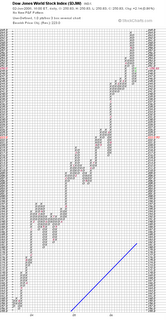

The first chart is the Dow Jones World daily line chart (click to enlarge):

As can be seen, the index has bounced off the rising support line 5 times now. This area around 241-244 is a great line of support. A break below will be a further confirmation of a sell signal and should this occur I will switch to 100% cash.

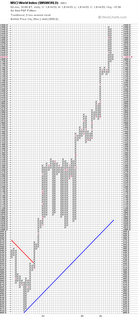

Further to the above, here is my personal PNF chart I use:

It is clear that there is price congestion (ie. price support) in the 241-244 area. Any price above this level is bullish even though technically on this chart it is on a sell signal (when I went to 50% cash). Also note any break below the 241-244 level and there is next to no support until around 226 (almost an 8% decline).

Last chart is a traditional PNF of the MSCI World Index (the benchmark used by our mutual fund companies to judge their performance):

The key thing to note here is how quickly the price rose once it finally broke above the 1330 price level in Oct, 2004. That is a 46.6% rise in 1 year 7 months; very unusual for a world index and at a rate that is unsustainable.

Has it topped? Impossible to say at present. The chart is still on a buy signal and will continue to do so until a break of 1790. Should this occur there is price support in the 1730-1760 area. Any break below this and there is very little price support due to the rapid rise until 1330 (which would be a 27% decline from present levels). Not saying it will happen (yet?) but it is certainly possible.

Bottom line is I'm still 50% equities, 50% cash and watching closely.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home