Update Nov 21, 2006

It has been 2 months since my last post. During this entire time I have remained safely in cash in the Emirates Provident fund.

I must admit it has been frustrating watching the markets run away over the past 2 months. As I have written about previously, the markets have a well established history over the past 100 years of bottoming in the Oct-Nov time period in the 2nd year of a presidential cycle (the mid term elections). In fact, of the 24 times where the mid term elections have occured over the past 100 years only 6 times has the market not produced a bottom in the Oct-Nov time period. This combined with a seasonal yearly propensity to bottom in the Oct-Nov period had me out of the markets for the past few months.

The combination of the the two "should" have produced the following results:

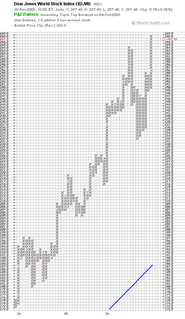

As can be seen, I expected given history the markets would fall to around the 226 level. This is the last level of resistance which became support when it was broken to the upside on the early 2006 run up. This can be seen in the 1 box PNF chart below:

From the 226 level I expected a traditional summer rally (which historically occurs each summer and did so again this year). Where things did not go as predicted is that I expected this rally to only extend to the level of the previous sell signal around 251 and then continue down to a final bottom in the Oct-Nov time period around 196-206 support level.

The important thing to understand about Technical Analysis is that it is not a magic bullet that works 100% of the time. I like to think of it as more like a "windsock" than a "crystal ball". It does not show the future. What it does do is give you an indication of the "direction the wind is blowing" (also known as the Trend) to allow you to make informed investment decisions.

Having said all that, in hindsight would I have done anything different? The answer is no. When the sell signal occured in May and I went to cash I commited based upon historical patterns to remain in cash until after the mid term elections which occured on Nov 6. The "odds" favoured playing it safe and that is what I did. It is important to remember that cash IS a position and there are certain times when it is in your favour to be in the market and certain times when it is not in your favour. When dealing with the provident fund I play it safe; I have other stock investments I utilize on a daily basis to "work the market".

So enough of that. The question now is where are we, where we might go and what will we do. If you refer back to my daily PNF chart you can see the chart gave a buy signal as the price past through 247. This occured on Aug 04. Since then it has run up to the 268 level (+8.5%) and has been steady around this level. The 6 month daily line chart shows the advance well:

The most important thing to note on this chart is that the momentum of the current rally is fading. Note that the 14 day RSI (relative strength indicator) has been declining as the market continues to push ahead in price. This is known as a negative divergence and is a sign that a significant part of the "smart money" is leaving the markets as the "dumb money" is coming in to replace it. In addition note the StochRsi is weakening, the Stochastic is in overbought territory (above 80) and the MACD is flat (this indicates momentum is flat). Lastly, note the trendline appears to have been violated as of yesterday.

Based upon the above, I will continue to hold cash as there are considerable risks to this market. We have entered what should be a very profitable period over the next few months (up to May) but the market is way overbought and due for a correction. Once this occurs I will be moving 100% back into the markets but only when the risk/reward is in my favour. It currently is not.

As we have now returned to the "interesting" time of year for the markets, I will be updating this blog on a much more regular basis. I will include a few thoughts outside of technical's to give you some idea of the fundamental's and where we might be going. While I have turned somewhat bullish over the near term there are some very severe storm clouds on my radar that could make for a very "interesting" summer next year.

That will close this update. Thanks to all those who have spoken to me about the site and the questions/comments. If any of you has specific questions please feel free to ask. I won't work on specific stock picks, companies, etc but will provide info that I feel is of use to the entire EK pilot group. I plan on doing some work on precious metals over the next month (of which I own personally in my trading account and also hold as gold bullion) and maybe something on bonds (which have the potential for significant profit in the next 6 months).

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home