Stock Update 21 February 2007

No change in position, still 50% long equities and 50% cash (Euro's) in the A/B account.

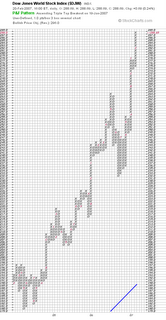

The world's stock markets have shown unbelievable strength over the past 6 months due to the incredible amount of liquidity being produced by central banks around the world. Since the Dow Jones World index PNF chart gave a buy signal on 04 Aug 2006 through 247 the market has risen 16.9% (click on charts to enlarge them). This rate of appreciation is unsustainable and we are due for a correction. Hence my reluctance to switch to a 100% long equities position at this time.

When will the correction occur and how much will it correct? Will it be a minor "correction" and a good time to buy into the market or will it be a top and a good time to liquidate positions.............How long is a piece of string? Unfortunately technical analysis is not a crystal ball and any predictions are really nothing more than guesses.

The point is we will not know the top until it occurs and the correction is underway. At that point I will reassess my position and depending on the nature of the correction (based on the technical indicators) either switch to 100% cash (if it appears a top of significance is in) or go 100% long in equities (if it appears it is merely a correction in the continuation of the bull market). Until then I will hold my present positions.

0 Comments:

Post a Comment

Subscribe to Post Comments [Atom]

<< Home