Market Update 19 July 2006

It has been some time since I last updated the blog. The reason is not that I haven't been keeping an eye on the markets (I continue to do so each and every day), but that not much has changed over the past month.

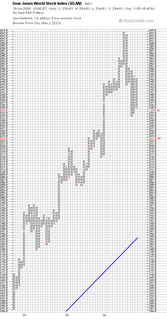

First chart is my customized DJW daily PNF chart:

As can be seen, the sell signal I issued on 17 May 2006 when the market broke through the 251 level was bang on. Since that date the Fidelity EK Managed Equity portfolio has lost 7.74% and the MLIM Managed Equity portfolio has lost 7.72%. During this period I have been in cash (as I indicated on my previous posts). I remain in cash as of today.

The market attempted a rally in June with the index topping out at around the 247 level before heading lower once again. Technically this chart would not indicate a new buy signal until a closing price at 248 or greater.

Longer term it is important to have a look at the weekly line chart:

As can be seen, the market has broken a well established uptrend line that has been in place since the end of the last bear market low in late 2003. This is an extremely bearish (negative) development and has to be watched closely. Levels of support are indicated to show where reversals might occur.

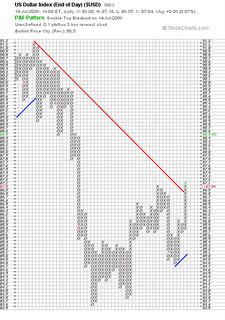

As stated, I have been 50% USD, 25% Australian dollar and 25% Euro since going to cash. Contrary to all the talk about how the USD is doomed, it is actually behaving quite well to date:

It has held support above the 83.60-83.80 level I spoke about previous as my "line in the sand". A technical sell signal was issued through 86.30 but found support at the 84.80 level and issued a new buy signal through 85.70 (minor whipsaw action). Also it has broken above the last high at 87.00 and the red downtrend line. This is a potentially bullish development.

Having said that, I think it is premature to switch 100% back to the USD so I will continue to hold my Aussie/Euro positions at least for the next several days. The reason for this is TODAY is an extremely important day. The US consumer price index (CPI) for June will be released at 8:30 EST and at 10:00 EST Ben Bernanke (the US Federal reserve chairman) will be giving his semi-annual update to the US congress. These are two key events that have the potential to move all the markets (including stocks, bonds, currencies and gold) in a very big way. Think of it as an earthquake that has the potential to generate a tsunami; not saying it will happen and not every earthquake does generate a tsnunami but it certainly is possible. As such I'm very comfortable with my current cash-neutral position until after this event takes place and the charts point to the outcome.

Where do we go from here? The markets are quite oversold at this point and they are due for a dead-cat bounce. However I ultimately think we are in for a much greater correction after this bounce before we find a bottom. How much further down is a guessing game but I suspect over the next 6-8 weeks we could have much more weakness.

I still expect a major bottom sometime in Sept or Oct at which point I full expect to reinvest back into the EK equity funds. This bottom I feel will be an excellent buying opportunity for a substantial move upwards. My guess is this rally could last through the first quarter of 2007. However, the more I look at the data the more I think there is a very good chance of a recession in the U.S. beginning in the 2nd quarter of 2007. As such, I expect mid to late first quarter 2007 I will be exiting stocks and entering bond positions.