Stock Update 28 February 2007

A very quick update to those who are wondering what the he## went on yesterday.

Huge correction in the Chinese market (long overdue) combined with weak US Durable goods orders (ie big ticket items such as airplanes, cars, appliances, etc) led to this decline.

This could be the buying opportunity I was looking for to get fully long; it could be the selling opportunity I am looking for to go to cash. Bottom line is the correction I warned about has begun (either a blip or the start of a bear market has yet to be determined).

The markets were too frothy and the correction I warned about has occurred (ironically the day before the annual Emirates Group provident fund meeting that unfortunately I am unable to attend this year).

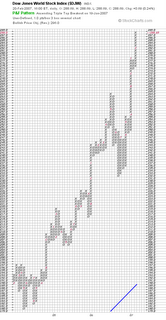

Next.......what now? Here is the 1 box PNF I use to give me an indication of market direction (click to enlarge):

Bottom line: no change in position as of today. Holding 50% equities/50% cash position and looking to either go fully long (ie. a 100% equity position) or sell to cash.

Here is how I will play this:

-A daily close close below 274 and I will go to cash (currency yet to be determined if/when this occurs).

-A price reversal upwards that indicates a new buy signal will result in me going 100% long (ie. fully invested in equities).

I have no idea which way it might go....will advise when I have made my move.