From my last update 09 July:

"This action has formed what appears to be a "textbook" Head and Shoulders topping pattern. The symmetry is nearly perfect and the time between the Head and the Shoulders is ideal. The neckline (shown as the red line) is the trigger should we continue to decline from here."

"The length of the pattern from the Head to the neckline is approximately 124 points; on a break of the neckline the price objective would be 124 points below the breakpoint of the neckline. Will we get there; too early to tell. But it does bear watching (for other reasons I will explain below)."

"It appears we continue to remain within a bearish rising wedge off the 666 low in Mar, 2009. Any weekly close below the lower trend line would have to be taken as a serious indication the bear market decline had begun. Too early to count our chickens but watching that trend line closely."

"Seasonally we are in the summer period where markets move rapidly on little volume. They traditionally drift sideways to slightly up in June/July followed by a correction mid-Aug into late Sept/early Oct. That is what I expect may happen but will use my technical indictors to guide me."

It has been a very interesting few weeks with the sovereign debt problems in Europe and the clown act in Washington. As a result, the markets have moved to a critical juncture which need to be monitored closely over the next few days. There are times in any given market where a critical tipping point is reached and it could go literally either way. We are at that point today.

I continue to read with amusement the fearful predictions from "analysts" who attempt to prognosticate the direction of the market. Truth be told at this juncture anyone who tells you with certainty that they know how this is all going to play out is pure media hype. We have NEVER been here before in the history of capitalism so how can anyone with certainty prognosticate the future direction?

My "gut" tells me we are in deep doo-doo but "gut" reactions is what 99% of investors use when making decisions; and 99% of the time they are WRONG. I've learned through years of experience to ignore my "gut" and let the technical indicators tell me where we are. There are telltale signs in the technicals that will tell us WHEN (not if) we are in trouble. I will speak about those in this blog.

Click on all charts to enlarge

1)

The Forest and the Trees

In investing it is important to look to the forest first and then drill down to looking at the trees next. As I have written about before, it is my belief we are in the "Winter" phase of the Kondratieff Long Wave Cycle. The Long Wave Cycle has historically been a period of approximately 60-80 years with 45-60 "good" years and 15-20 "bad" years.

It is my belief we entered the Winter phase in 2000 and, had Greenspan let the Capitalist market cycle do as it should, it would have led to a period of 15 odd years of decline to cleanse the excesses out of the system built up over the last 55 "good" years (1945-2000).

Instead, believing the U.S. Federal Reserve had the power to literally defy "economic gravity", he juiced the system with so much liquidity that it delayed the onset of the Winter cycle. The outcome of the "juice" was the housing bubble which ultimately let to a much worse economic condition than that which existed in 2000. Bernanke has done nothing more than to again try to defy "economic gravity" by way of the QE 1 and QE 2 in the desperate hope to once again delay the inevitable.

This Winter period in technical analysis terms is known as a Secular Bear Market. The last secular bear market began in 1929 with the Great Depression and ended in 1955 (26 years later). It took a severe deflation along with the loss of millions of lives in a world war to expunge the excesses from the Capitalist system built up over the previous 45 years. I fear that will happen again at some point (a later discussion) but for now all the attempts at delaying a period of required severe deflation (which would require the writing down of massive amounts of debt, the bankruptcy of 1000's of banks and the losses of millions of jobs worldwide) is doing nothing more than delaying the inevitable. You cannot escape economic gravity; you can merely hide and delay the path to be followed. You cannot cure a cancer patient by pumping him with aspirin and pretending all is well; it takes surgery (sometimes drastic) to cut the cancer from the body. The built up debt in the current system is the cancer.

The good news is within every secular bear market there are cyclical bull markets. These periods are counter-trend moves that go opposite the direction of the secular bear market. We had one in the period 2003-2007 and we are still currently in our current one (2009-present). At some point this cyclical bull market will end and we will again move with the trend of the secular bear market. The key is to understand the economic world in which we find ourselves and have a battle plan to survive to the next Spring (the next secular bull market).

How will we know we have exited the secular bear market and entered the next secular bull market phase. A quick look at a chart from 1900-present shows the peak of 380 reached in 1929 was not surpassed again until 1955. That was the point at which the next secular bull market began.

|

| DJIA 1900-Present |

Using history as a guide until we can get above 13930 (in inflation adjusted Dow points) we must assume we remain within the secular bear market.

2) Monthly Chart

|

| SPX Monthly |

The markets have been stuck in a trading range for entire 2011 year to date. I have indicated the range in the black box on the chart.

Note that the top of the 2 previous bull markets were defined by periods of 8-9 months where a trading range was established which eventually was broken to the downside. Coincident with these trading range breakdowns was a monthly close below the 12 month simple moving average along with at least one of the technical indicators confirming the move.

As we stand today we are on the verge of a possible break below the current trading range. We are also below the 12 mSMA (1278.66). HOWEVER none of the technical indicators has yet to confirm the price action. Also my month chart does not turn bearish until the MONTH closes below the 12 mSMA. It did not do so in July; we are below it inter-month in August but it would have to close below the 12mSMA at the end of August (along with at least 1 technical indicator confirming; the more the better) to be reasonable certain we have entered the next bear market. We are not there yet.

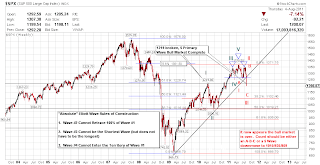

3) Weekly Chart

|

| SPX Weekly |

The 3 year weekly chart clearly shows we have broken below the trend line established from the March, 2009 low. The boxed area clearly shows our trading range for the past 31 weeks. The technical indicators are are bearish indicating the intermediate term direction of the markets is down.

The key to note on this chart is the Elliott Wave numbering. As I have spoken about previous, my current count has us in wave IV of a five wave advance (green numbers on the chart). If this count is correct, we should be bottoming here and starting our next move up to point V on the chart. That level would be approximately 1440 on the SPX.

The problem with Elliott Wave analysis is there is always an "alternate count". That count is shown on the chart as A-B-C in red. If this count were to be correct, we would have topped in late April @1370 and we could expect the start of a multi-month bear market decline.

How will we know which count is correct? As I wrote about previous, one of the "hard rules" of Elliott Wave is wave IV cannot overlap wave I. As wave I topped @ 1219, any close below this level would negate the bullish "5 wave" count and activate the bearish "A-B-C" count. Another reason to watch the markets closely over the next week.

4)

Daily Chart

|

| SPX Daily 6 month |

The daily chart shows the break of the triangle we were within and the test yesterday of the lows @ 1249.05. It is extremely interesting to note price inter-day pushed below this support but by the end of the day the bulls regained control and pushed the market back up to close above this level.

It is also interesting to note the volume on this daily advance was the highest up volume since March 20; the start of a multi week market advance. Will we get the same again? We'll find out soon enough.

|

| SPX Daily Trend Line |

It is also interesting to note we have now broken the trend line from the 2009 bottom. Note we are currently in the fairly strong volumetric support/resistance area defined by 1250-1305. Should we break below the next strong level is not until 1140-1190. This would tie in nicely with the targets on the head and shoulders pattern discussed next.

5)

60 Minute Chart

|

| SPX 60 Minute |

I spoke in my last blog about what appeared to be a "head and shoulders" topping pattern forming on the 60 minute chart. That pattern is now fully formed and in play as price broke below the "neckline" of the pattern as indicated on the chart.

The target objective based upon the formation of the chart is 1150 on the SPX. If this pattern works out "textbook" that would move us below our magical 1219 level and set the stage for the next bear market. Another piece to the puzzle.

Bottom Line

-we are within a secular bear market from 2000 (indisputable)

-we are within a cyclical bull market from 2009 (indisputable)

-we are very close to a bear market signal on the monthly chart (no technical indicator confirmation)

-we are on the cusp of a breakdown of a 31 week trading range on the weekly chart (but have yet to close below the range and the week is still not finished)

-we are hanging onto support on the daily chart (pushed below the March lows @1249.05 but could not close below that level)

-we have a completed head and shoulders topping pattern on the daily chart (target of 1150)

-we are very close to an Elliott Wave bearish signal on a close below 1219 (which would confirm the next cyclical bear market has begun).

As can be seen, we are at a tipping point. This could be an incredible buying opportunity (if we have bottomed and are on our way to a wave V top) or it could be the cusp of the next bear market.

It is times like this you need to concentrate on the indicators. They will tell me soon enough which way I need to be positioned. For now they are telling me to sit on my hands, watch and wait. Sometimes the best thing you can do is nothing at all.

Emirates Provident Fund:

As of Friday, 08 July 2011 I remain in a strategic 50% equities/50% USD cash weighting as follows:**

-BlackRock US Dollar Cash Portfolio Fund: 50%

-Russell Global 90 Fund: 15%

-Fidelity International Fund: 10%

-BlackRock Managed Equity Fund: 25%

**Actual positions will change daily based upon price action and market volatility.

Legal Disclaimer: The content on this site is provided without any warranty, express or implied. All opinions expressed on this site are those of the author and may contain errors or omissions. NO MATERIAL HERE CONSTITUTES "INVESTMENT ADVICE" NOR IS IT A RECOMMENDATION TO BUY OR SELL ANY FINANCIAL INSTRUMENT, INCLUDING BUT NOT LIMITED TO STOCKS, OPTIONS, BONDS OR FUTURES. The author will reveal his current market positions and holdings but actions you undertake as a consequence of any analysis, opinion or advertisement on this site are your sole responsibility. The author is not licensed as an investment advisor in the UAE and therefore cannot provide individual account advice to individuals and/or institutions.

For further information please use the following email address and I will do my best to get back to you when able.

ecamquestions@gmail.com