As most readers are aware; since I started the ECAM blog site in 2006 my emphasis has always been to deliver to subscribers' timely investment analysis with a mandate towards delivery of absolute return performance.

In the past few years I have received many personal emails supporting my efforts. As an example, this is one of hundreds of emails I've received over the years (the sender's office has been removed to protect personal privacy)

Hi Dwayne,

I have been an avid follower of your blog site for many, many years.

By following your site, and advice, I avoided the stock market crash of 2008, and have nothing but admiration for your insightful observance of the stock markets.

I work for the XXXXX XXX XXXX and have been in the Provident Fund for nearly 14 years.

Have you stopped your blogs as I can not find any after August 2013?

Kind regards,

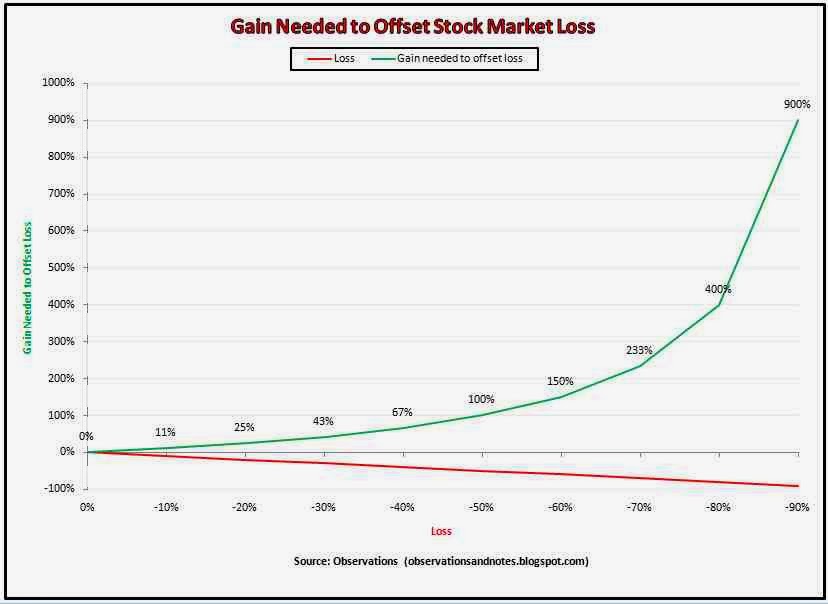

My obsession to not lose money through complete market cycles irrespective of market conditions comes from the simple math that avoidance of substantive market declines is paramount to long term success in portfolio management. Once again, consider the following chart of loss vs. required future gain (a 50% loss requires a 100% gain):

In numerous discussions I've had with subscribers over the years, the overriding request I've received has been whether I would be willing to provide greater tools/education/analysis in guiding subscribers towards their ultimate retirement goals. Up until recently I have been hesitant to do so as the time, effort and sacrifice I would endure attempting such an endeavor precluded me from tackling such a project. However, it has come to the point where I feel compelled to move forward.

What has led me to this decision is some recent work I have done as a consultant to an Independent Financial Advisor organization. Having had an opportunity to once again explore the vast range of analytic tools available to assist with retirement planning, I was appalled to look at the current offering Emirates Airlines offers to its employees through Watson Wyatt. Without stating the obvious; Emirates offers the single worst services of any major corporation I have reviewed when assessing the degree to which they have attempted to provided tools/assistance to employees required to be enrolled in a company Defined Contribution Pension Scheme (of which you are one).

Given such, I have decided to move ahead with what I hope will become an integral part of your future personal pension planning. I have worked with a website designer to develop a new site which I hope will become an integral part of your retirement investment process going forward. The intent of the site is to offer a number of tools along with analysis and commentary which I hope will become my legacy to Emirates employees as their single best source of guidance to assist with their self-management of their individual retirement accounts.

The new website is

Emirates Capital Asset Management.

The new website is still under final development as content is still being added. I hope the new site will be of enormous benefit to members. My intent is to provide a one-stop venue to allow members an opportunity to maximize their investment returns (both Provident Fund and otherwise). Given the 24/7 monitoring and proprietary investment analysis this service will provide, the service will be offered at an extremely reasonable fee to offset my personal time commitments (a minuscule percentage of value of most member's Provident Scheme account balances).

I will continue to run the current ECAM blog site with redirects to the new ECAM blog site. There will be no asset analysis under the old blog site; only redirects to the new site's blog pages. For those who just want to use some of the links/blog entries on the new site; those will be available to everyone. However, given ECAM's success in delivering absolute return performance, I hope you'll consider the minuscule/fractional cost of subscribing to the full retirement service.

To be honest, I am 100% committed to delivery of absolute return performance (as those of you who have followed the site over the years know). I would expect those who truly care about their retirement portfolio accounts to pay a small fraction of it's percentage value to acquire 24/7 analysis and protection of their portfolio (0.40 cents per day). If you are not such a type (or one who cannot justify 0.40 cents/day to manage your future retirement) I wish you good luck.

By way of perspective, the yearly fee is less than a single "cheap" night out in Dubai. I have priced the service exceedingly reasonably and only want those who are serious about their retirement futures to subscribe.

Sorry to be blunt but those who know me know I am not a time waster; I am committed to delivery of absolute returns. I seek like-minded subscribers.

Dwayne Malone

Emirates Capital Asset Management (ECAM)