Fidelity Emirates Managed Equities Portfolio-$17.13 (27 Apr)

MLIM Emirates Managed Equities Portfolio-$15.76 (27 Apr)

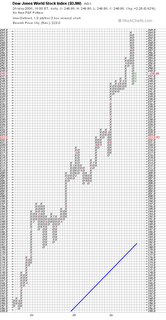

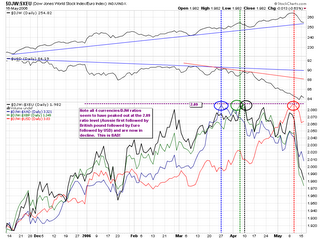

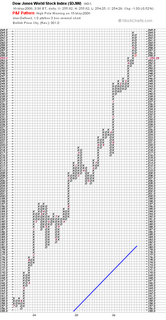

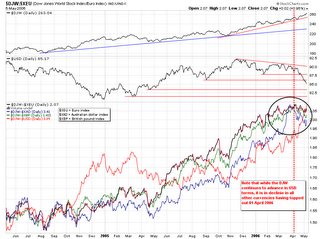

The worlds markets remained in a very tight pattern the past week with very little price action. The Fidelity fund gained 0.29% and the MLIM fund lost 0.88%. The market internals in the U.S. continue to deteriorate. This along with the seasonal tendency I commented on previous has me looking very closely at the charts. I suspect a correction of significance is forthcoming

very soon but until the reversal takes place it would be premature to jump the gun and switch into cash.

What might turn the markets? No one knows but here is an interesting article taken from an Iranian website:

Iran oil bourse next week

Apr 26, 2006

Oil Minister Kazem Vaziri Hamaneh said on Wednesday that the establishment of Oil Stock Exchange is in its final stage and the bourse will be launched in Iran in the next week.

He told reporters, upon arrival from Qatar where he attended the 10th General Assembly of International Energy Agency and consultations with OPEC member states, that registration of the Oil Stock Exchange is underway and the entity will operate after being approved by by Council of Stock Exchange.

He rejected a statement attributed to him saying that Oil Stock Exchange will bring to the ground the US economy and said, "I don't know who has speculated that I've not talked about US economy." Asked about conference on energy in Doha, he said that more than 60 countries and 30 oil companies and consultants took part in the conference.

Vaziri Hamaneh said that serious discussions were held including security of supply and demand, security of investment in energy and environment issues.

"The best method for security of demand in the oil sector is that consumers should be given opportunity to enter into partnership with the suppliers in investment in oil industry."

He said that the conference called for diversifying energy resources and cooperation of the developed states with the countries possessing oil and gas resources.

Asked about the oil price rise, Vaziri-Hamaneh said that oil price is being influenced by political situation, whereas it should be freed from political impacts and economic and technical fundamentals should determine the oil prices.

"As long as political impacts dominate the oil market, price hike will continue," he concluded.

Couple this with the following from the Business Telegraph dated 23 April 2006:The threat to a fistful of petrodollars

By Liam Halligan (Filed: 23/04/2006)

From Russia, you might say, with love. This weekend, Alexei Kudrin, Russia's finance minister, dropped a bombshell in Washington.

Attending the annual meetings of the World Bank and International Monetary Fund, Kudrin caused his American hosts discomfort by openly questioning the dollar's pre-eminence as the world's "absolute" reserve currency.

The greenback's recent volatility and the yawning US trade deficit, "are definitely causing concern with regard to its reserve currency status," he said. "The international community can hardly be satisfied with this instability."

Kudrin's intervention coincided with another meeting, also in Washington, of finance ministers and central bankers from the Group of Seven - which doesn't include Russia.

Top of the agenda: the effect of ever-rising oil prices on inflation and interest rates.

G7 countries are worried the spiraling price of crude - which closed at $72.79 a barrel on Friday and which has now trebled in three years - could inflict real economic damage. The US Federal Reserve, in particular, has been forced to take drastic action - raising interest rates 15 times since June 2004 to keep inflation in check.

Given that fragility, it is significant that Kudrin is now wondering aloud if the long-standing dollar hegemony can last. For him to do so is to highlight that America is vulnerable should that status be lost. That's because Russia, with its awesome oil and gas reserves, could kick-start a challenge to the dollar's supremacy.

Most nations stockpile their foreign exchange holdings in dollars. The US currency accounts for more than two thirds of all central bank reserves worldwide.

This reserve status means that the dollar is constantly in demand, whatever the underlying strength of the US economy.

And now, with massive trade and budget deficits to finance, America is increasingly reliant on that status. The unprecedented weight of US liabilities means a threat to the dollar's dominance could result in a currency collapse, plunging the world's largest economy into recession.

That won't happen immediately. The dollar has sat astride the globe for some time now - in fact, for most of the last century. But this statement from Russia - a country of growing financial and strategic significance - still caused the dollar to slide. It also fuelled speculation that central banks could increasingly diversify their holdings away from dollars.

Kudrin's statement followed news that Sweden has cut its dollar holdings, from 37 per cent of central bank reserves to 20 per cent, with the euro's share rising to 50 per cent. Central banks in some Gulf states have also lately mooted a shift into the euro. Such sentiments helped push the dollar to a seven-month low against the single currency last week.

But Russia's intervention will have raised eyebrows in Washington because the backbone of the dollar's reserve currency status - the main guarantee that status continues -is the fact that oil is traded in dollars. And that is something the likes of Kudrin can directly affect.

For historic reasons, the dollar remains the world's "petrocurrency" - the only currency for the settlement of oil contracts on world markets. That makes the EU and Russia dependent on it. But with central banks switching to euros, the logical next step would be for fuel-exporting countries to start quoting oil prices in euros too.

The EU is Russia's main trading partner. More than two thirds of Russia's oil and gas is exported to the EU. That makes Russia a strong candidate to become the first major oil exporter to start trading in euros. Such a scenario, in recent years, has become theoretically possible. But now, with these latest comments, Kudrin has thrust that possibility into the open.

The G7 meeting was dominated, of course, by concern over Iran's nuclear programme. The threat of military action against Iran, itself a major crude exporter, is one reason oil prices are now testing record highs.

It is worth noting that Tehran has ongoing plans to set up an oil trading exchange to compete with New York's NYMEX and with London's International Petroleum Exchange. In the light of Kudrin's comments, it is significant that the Iranians want to run their oil bourse in euros, not dollars.

Were the Iranians to establish a Middle-East based euro-only oil exchange, the dollar's unique petrocurrency status could unravel. That, in turn, would threaten its broader dominance - which, given America's groaning twin deficit, could seriously hurt the US economy.Some cite this as the real reason the US wants to attack Iran: to protect the dollar's unique position. I wouldn't go that far, but the prospect of a non-dollar oil exchange in Tehran is certainly an aggravating factor.

The opening of Iran's new oil exchange has recently been delayed. But, having spoken with numerous officials in Tehran, and western consultants who've been working with the Iranians for several years, I think it will go ahead. The exchange entity has already been legally incorporated in Iran and a site purchased to house administrative and regulatory staff.

The reality is that as long as most of Opec's oil - read Saudi Arabia - is priced in dollars, the US currency will retain its hegemony. But the opening of an oil bourse in Tehran, which now looks likely, will signal at least tacit Saudi consent for euro-based oil trading. The US knows this, which is why it is nervous about the dollar's status being questioned.

From the G7's fringe, Kudrin has now touched this raw nerve. This weekend's meetings have been dominated by questions of global financial imbalance - in particular, America's huge deficits.

Kudrin's missive comes as central bankers, and currency dealers, start to conclude the only way to resolve the massive US external deficit is a somewhat weaker US currency. As the IMF itself warned yesterday, a "substantial" dollar decline may be needed.

One way to bring that about would be for the euro to enter the global oil trading system. This is unlikely to happen soon. It might not happen at all. But the idea is now not only realistic but firmly on the table in Washington. Perhaps not with love, but it was placed there by the Russians.